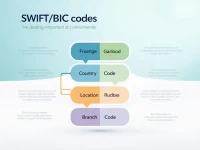

SWIFTBIC Codes Key to Efficient International Money Transfers

This article introduces the SWIFT/BIC code of DEUTSCHE BANK AG-POSTBANK BRANCH and its significance in international remittances. It illustrates the exchange rate from USD to EUR and the associated remittance fees through examples, emphasizing the crucial role of accurately using the SWIFT/BIC code to ensure the swift transfer of funds.